Variable Consideration Implementing Options in Oracle Revenue Management Cloud Services

Introduction:

Oracle Revenue Management Cloud Service (ORMCS) is one of the fastest growing Cloud services offered by Oracle for ASC 606 implementation. ORMCS can be taken as a standalone service or a Bundle Service as it stays on the same fusion SaaS stack.

The latest version 20D is now supporting direct data Integration from Fusion Order Orchestration, Fusion Account Receivables, Fusion Subscription Management & Fusion Contract.

This blog is based on the options available to implement Variable Consideration in ORMCS. Let us first walk you through a few key concepts.

What is Variable Consideration in ASC 606?

Variable Consideration occurs when an organization originally estimates contract terms at the inception of the contract, and later the organization needs to adjust the initial estimate.

In ORMCS, this concept is known as Estimate Correction. Estimate Correction can be Term adjustment, Sell Price Adjustment, Quantity adjustment, or Material impact.

Example for VC or EC:

A company sells Bundle Hardware + Services items to partners/distributors in bulk. At the time of inception, a business does not know the actual returns in the future. Business users study the market and come up with a fixed transaction price and revenue for the Item. Revenue Contract created with this consideration may not be accurate as actuals depend on the number of Hardware Activated or Returned. This is known as VC Price and VC Revenue, which depends on future events.

Different Options Available to implement EC/VC in ORMCS:

Use case 1: Perform Contract Adjustment

Sell Amount = 1257

Final Sell Adjustment Required = 1134

No change in SSP

Adjust Revenue based on Selling price

Setups Required:

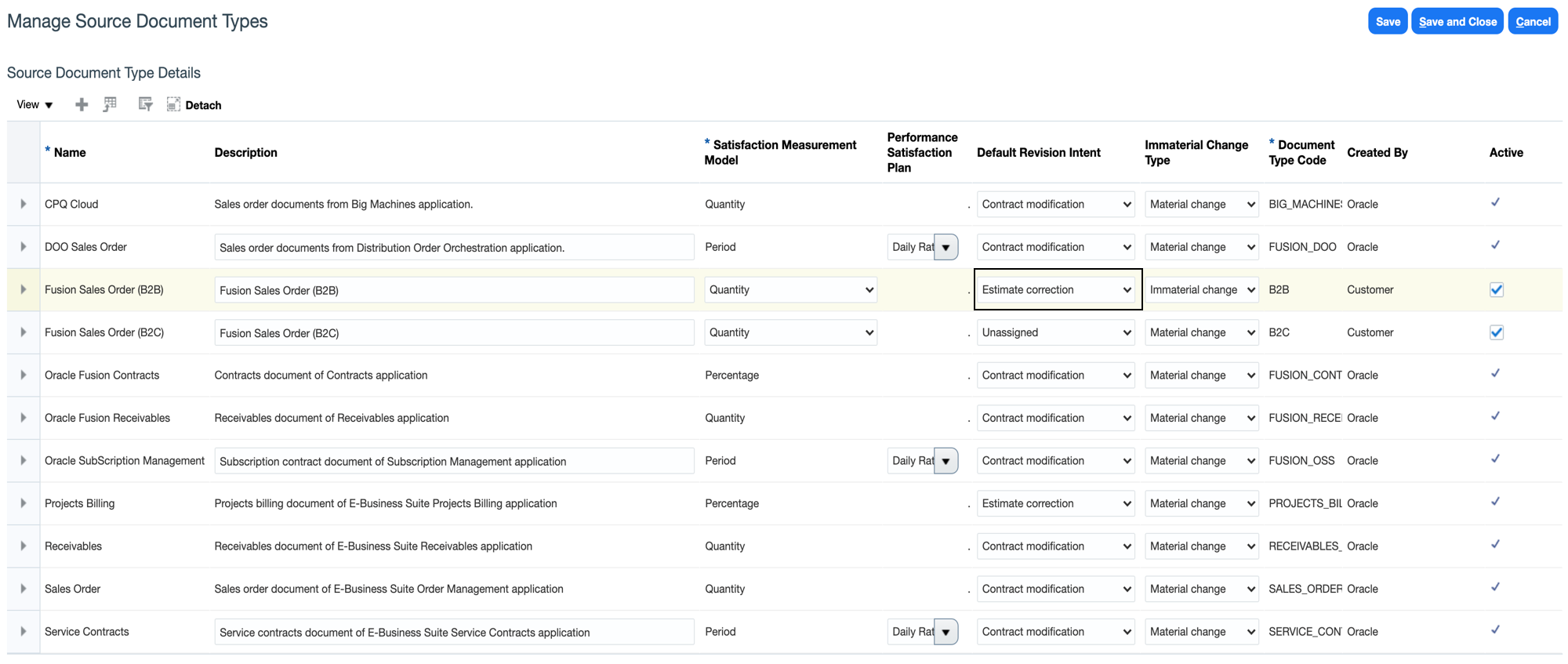

Enable Revision intent type for the Source Document Type.

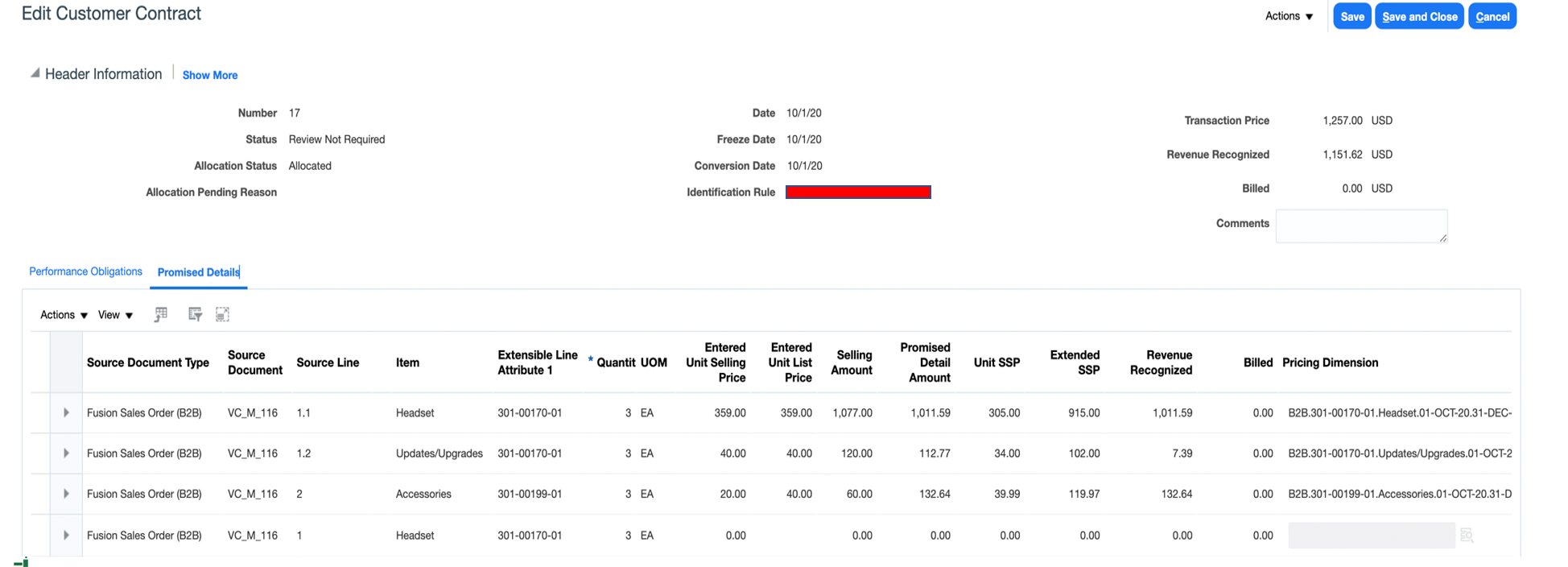

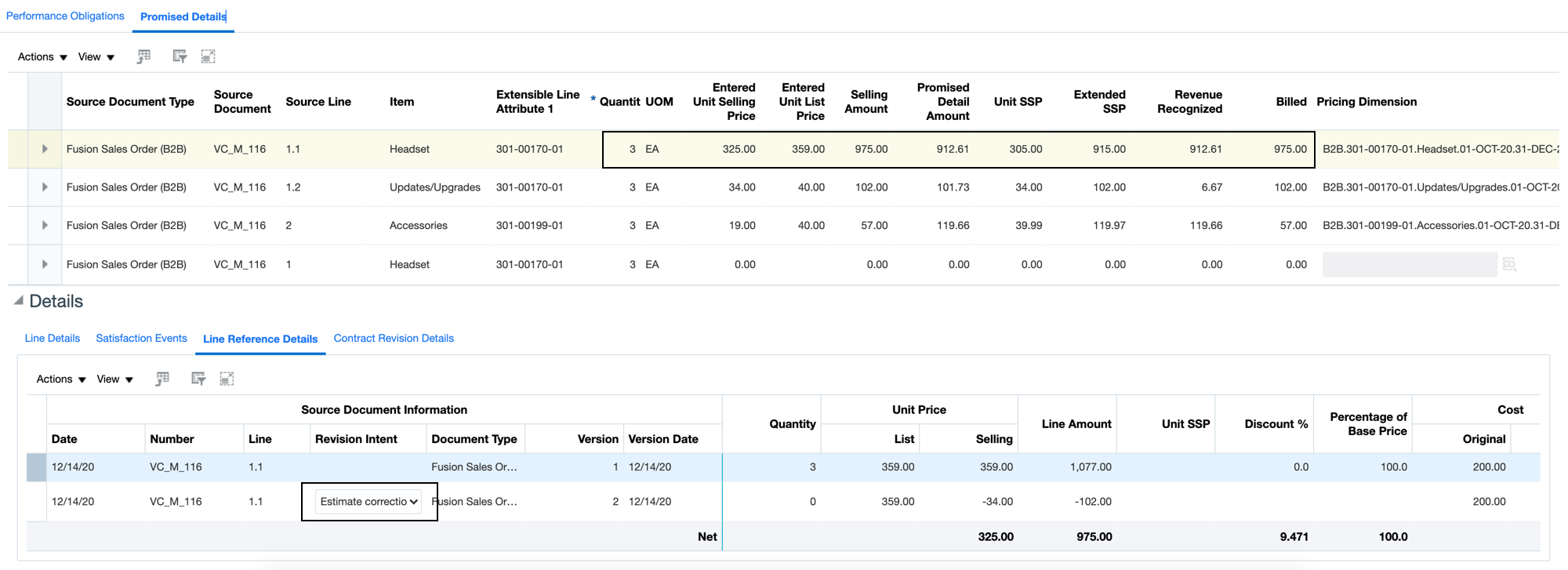

Inception order:

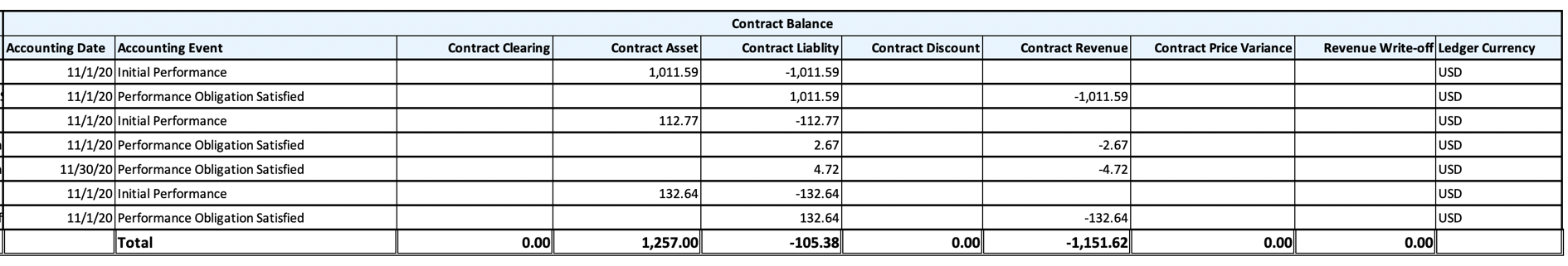

All Contract Activities before Correction:

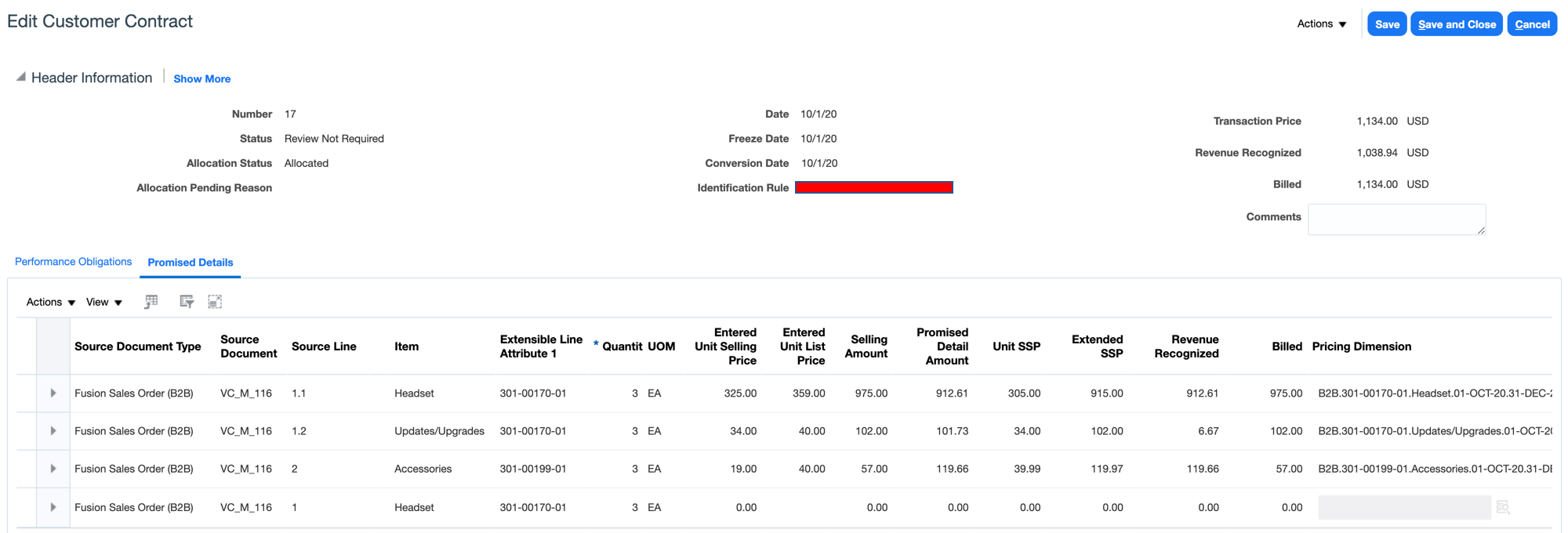

Collect Final Adjustment Amount:

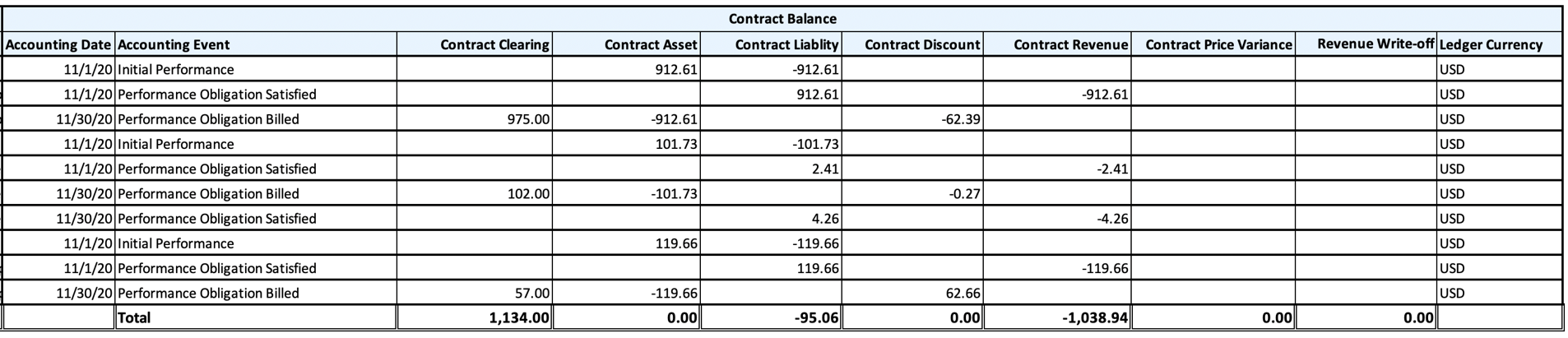

Final Contract Activity Report:

Use case 2: Reserve Return Account

Sell Amount = 1257

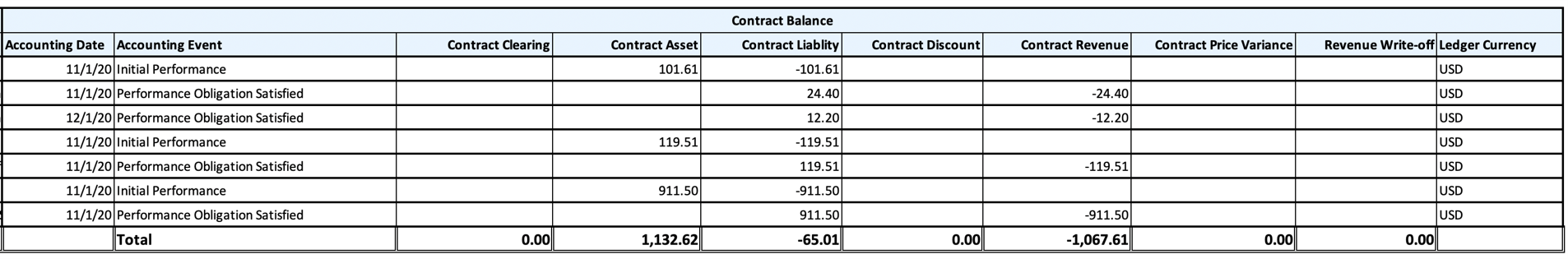

Expected Revenue = 1132.62

No change in SSP

Revenue in Reserve Return Account = 124.81

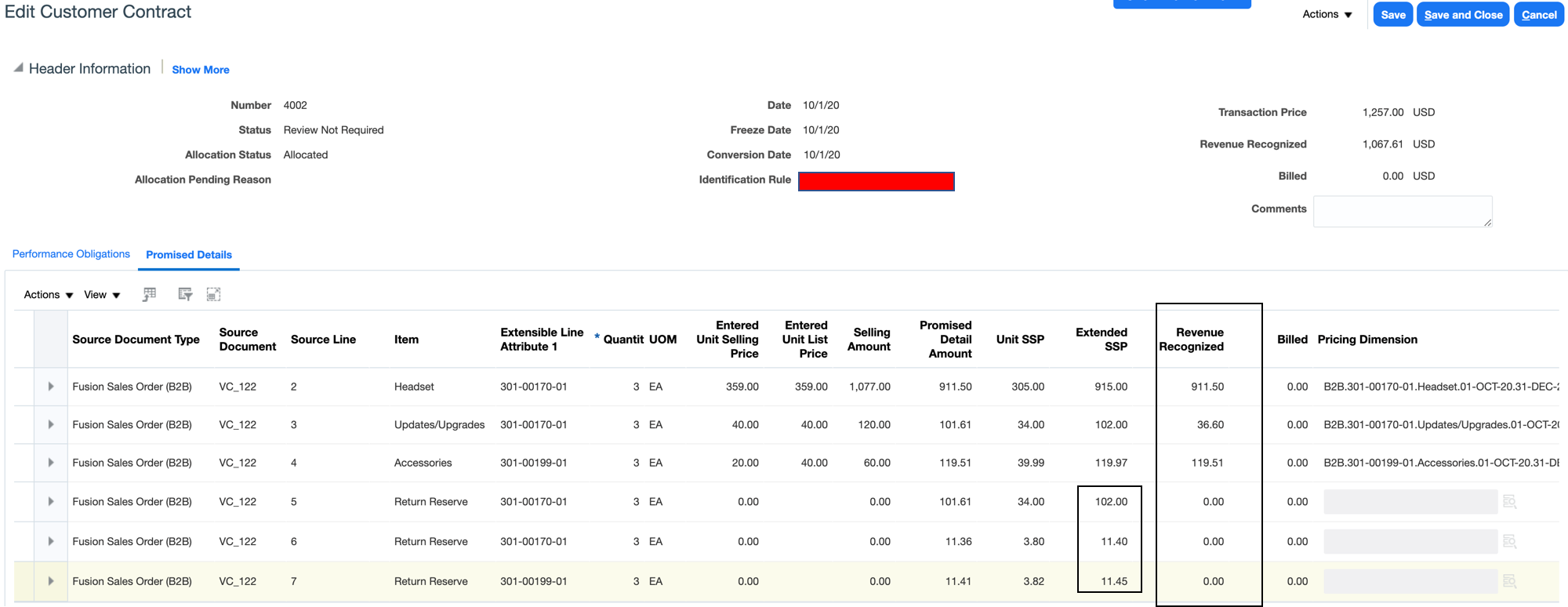

At the time of inception, Return Reserve Lines are created based on a fixed percentage or a fixed amount, which is the expected Return for the Item.

3 more lines dynamically create, which will contain 124.81 in Return Reserve Amount.

This remaining 124.31 will be either manually or automatically adjusted with Actual Return periodically. Learn more about Oracle cloud services

Original blog source: https://www.jadeglobal.com/blog/variable-consideration-implementing-options-oracle-revenue-management-cloud-services

Comments

Post a Comment